AI financial forecasting is the use of artificial intelligence to predict future financial outcomes. It involves applying smart computer programs, like machine learning algorithms, to analyze financial data and make predictions about things such as revenue, expenses, cash flow, and market trends. Unlike traditional methods that rely on simple calculations or human guesses, AI can handle huge amounts of data quickly and spot patterns that people might miss. This technology is becoming more popular in businesses because it helps reduce uncertainty and improve planning.

In simple terms, it’s like having a super-smart assistant that looks at past financial records, current market conditions, and even external factors like economic news to forecast what might happen next. For example, major companies are now using AI to upgrade their forecasting processes, making them more accurate and efficient.

How Does AI Financial Forecasting Work?

AI financial forecasting starts with collecting data from various sources, such as historical financial records, market reports, and real-time metrics. Machine learning models then process this data to identify trends and relationships. These models learn from the data over time, improving their predictions as they get more information.

Key steps include data preparation, where the information is cleaned and organized; model training, where the AI is taught using past data; and then generating forecasts. AI can use techniques like neural networks or predictive analytics to simulate different scenarios, such as best-case or worst-case outcomes. It also incorporates external variables, like weather for retail sales or economic indicators for stock prices.

Here’s a visual diagram showing how AI integrates into financial forecasting processes:

AI in banking and finance: Use cases, applications, AI agents …

Key Technologies and Methods in AI Financial Forecasting

Several technologies power AI in this field. Machine learning is the core, with subsets like deep learning for complex pattern recognition. Tools often use algorithms such as ARIMA (AutoRegressive Integrated Moving Average) enhanced with AI, or more advanced ones like LSTM (Long Short-Term Memory) networks for time-series data.

Other methods include natural language processing to analyze news articles for market sentiment, and generative AI for creating scenario-based forecasts. Cloud computing helps by providing the power to process large datasets quickly.

Benefits and Advantages

One major benefit is improved accuracy. AI can reduce forecasting errors by analyzing more data than humans can handle, leading to better business decisions. It also saves time by automating repetitive tasks, allowing finance teams to focus on strategy.

Another advantage is real-time updates. AI systems can adjust forecasts as new data comes in, helping companies respond quickly to changes. For CFOs, this means less uncertainty and stronger outcomes in planning. Overall, it drives efficiency, cost savings, and competitive edges.

Challenges and Limitations

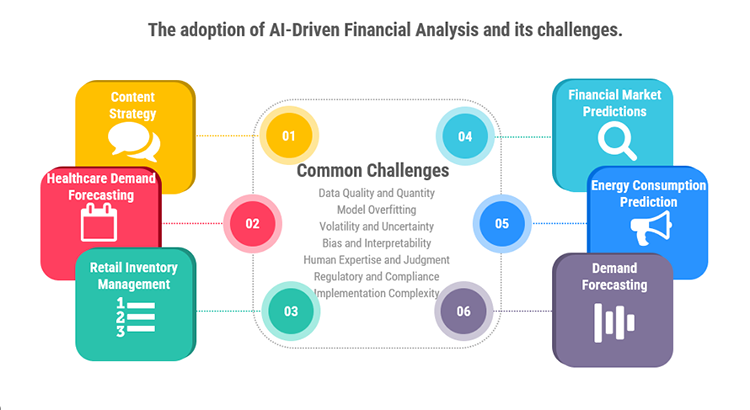

Despite the benefits, there are hurdles. Data quality is a big issue—if the input data is incomplete or biased, the forecasts can be wrong. AI also struggles with unexpected events, like sudden market crashes, because it relies on historical patterns.

Implementation challenges include integrating AI with existing systems, which can be complex and costly. There are ethical concerns too, such as bias in algorithms or privacy issues with sensitive financial data. Regulatory compliance is another area, as AI must meet financial standards.

Here’s a diagram highlighting common challenges in AI forecasting:

The Role of AI in Forecasting and Where It Falls Short

Real-World Applications

AI is used in various ways. In cash flow forecasting, it predicts inflows and outflows to help manage liquidity. For revenue forecasting, it analyzes sales data and market trends to estimate future earnings.

In banking, AI helps with fraud detection and personalized financial advice by forecasting risks. Retail businesses use it for inventory management, predicting demand based on factors like weather. It’s also applied in budgeting, expense management, and risk assessment.

Popular AI Financial Forecasting Tools

There are many tools available. For 2025, top ones include those that integrate AI for FP&A (Financial Planning and Analysis). Examples are Prophix, which helps with accurate planning, and Datarails for automating forecasts.

Other notable tools are Fuel Finance for scenario modeling and Workday for predictive analytics in corporate finance. Many offer features like real-time updates and integration with existing software.

Here’s an example interface from an AI accounting tool used in forecasting:

Future Trends in AI Financial Forecasting

Looking ahead to 2025 and beyond, AI is expected to integrate more deeply with finance. Trends include greater use of generative AI for automated projections and combining AI with behavioral data. Banks are predicted to fully adopt AI strategies, with 75% of large ones doing so by 2025.

The market is growing rapidly, projected to reach $190 billion by 2030. Expect more focus on personalized experiences, advanced fraud detection, and ethical AI practices. Overall, AI will make forecasting faster, more accurate, and integral to business strategy.

Conclusion

AI financial forecasting is transforming how businesses plan for the future. By leveraging smart technologies, it offers powerful insights while addressing traditional limitations. As it evolves, staying informed about tools, benefits, and challenges will help anyone get started in this exciting field.