What Are Robo-Advisors?

Robo-advisors are online tools that help people invest their money without needing much help from a person. They use computer programs, called algorithms, to build and manage investment plans. These plans are based on what you tell the system about your goals and how much risk you are okay with taking. Most robo-advisors focus on simple investments like stocks and bonds through funds that track the market.

:max_bytes(150000):strip_icc()/Roboadvisor-roboadviser_final-9c0f2c35944e4da6aae8646a832069d1.png)

What Is a Robo-Advisor?

They started as a way to make investing easier and cheaper for everyday people. Instead of paying a lot to talk to a financial expert, you can use these digital services for a small fee. Many robo-advisors are available through apps or websites, making it simple to check your investments anytime.

History of Robo-Advisors

The idea of robo-advisors began around 2008, right after a big financial crisis. That’s when companies like Betterment and Wealthfront launched. Betterment was one of the first, starting in 2010, and it aimed to make investing available to more people by using technology instead of human advisors.

Before that, in 2006, tools like Mint helped with personal finance tracking, which paved the way for automated investing. The early robo-advisors grew quickly because they offered low costs and easy access during a time when trust in traditional banks was low. By 2015, more companies joined, and big firms like Vanguard and Schwab started their own versions.

Over time, robo-advisors have evolved. They now include more features like tax strategies and even some human advice in hybrid models. The industry has grown a lot, with billions of dollars managed by these platforms today.

How Robo-Advisors Work

When you sign up for a robo-advisor, you start by answering questions about yourself. These might include your age, how much money you have to invest, your goals like saving for retirement or a house, and how comfortable you are with risks. The system uses this information to create a personalized investment plan.

The plan usually involves a mix of investments, often low-cost funds called ETFs that follow the stock market or bonds. The robo-advisor buys these for you automatically. It also watches your investments and makes changes, like rebalancing, to keep things on track. For example, if one part of your portfolio grows too much, it sells some and buys others to match your original plan.

Some advanced features include tax-loss harvesting, where the system sells losing investments to reduce your taxes. You can add money regularly, and the robo-advisor handles the rest with little input from you.

Pros and Cons of Robo-Advisors

Robo-advisors have many benefits, but they also have some downsides. Here is a simple breakdown:

| Aspect | Pros | Cons |

|---|---|---|

| Cost | Low fees, often 0.25% or less of your investments each year. No need for high minimum amounts to start. | Might still have extra costs for certain features, and performance fees could add up over time. |

| Ease of Use | Simple to set up online. Available 24/7 through apps. Great for beginners who want hands-off investing. | Less personal advice for complex situations like estate planning or big life changes. |

| Performance | Uses proven strategies based on modern theories to diversify and reduce risk. | Algorithms might not handle market crashes well or adapt to unique needs. No emotional support during tough times. |

| Accessibility | Open to anyone with internet. Helps remove human bias in decisions. | Relies on technology, so glitches or cyber risks could be an issue. Not ideal for very wealthy people needing custom plans. |

Overall, they are good for new investors or those with straightforward goals, but might not replace a human advisor for everyone.

Types of Robo-Advisors

There are a few main types. Pure robo-advisors are fully automated with no human input. Hybrid ones mix automation with access to real advisors for extra help. Some focus on specific areas, like sustainable investing or retirement planning.

Big banks offer their own, like Vanguard’s Digital Advisor or Fidelity Go, which might link to other banking services.

Fees and Costs

Most charge a yearly fee based on how much you invest, around 0.25% to 0.50%. There might be no account fees for small balances, like under $25,000 with Fidelity. Watch for extra costs from the funds themselves, called expense ratios, which are usually low.

Best Robo-Advisors in 2025

Based on recent reviews, here are some top ones for 2025. This list considers fees, features, and user ratings.

| Robo-Advisor | Key Features | Minimum Investment | Annual Fee |

|---|---|---|---|

| Betterment | Tax-loss harvesting, goal-based planning, human advice options. | $0 | 0.25% |

| Wealthfront | Advanced tax strategies, low fees, borrowing options. | $500 | 0.25% |

| Vanguard Digital Advisor | Low-cost funds, trusted brand, retirement focus. | $3,000 | 0.15%-0.20% |

| Fidelity Go | No fees under $25k, integrates with banking. | $0 | 0.35% over $25k |

| Schwab Intelligent Portfolios | No advisory fee, but higher fund costs. | $5,000 | 0% (but expense ratios apply) |

These are popular, but choose based on your needs. Morningstar ranks them highly for 2025.

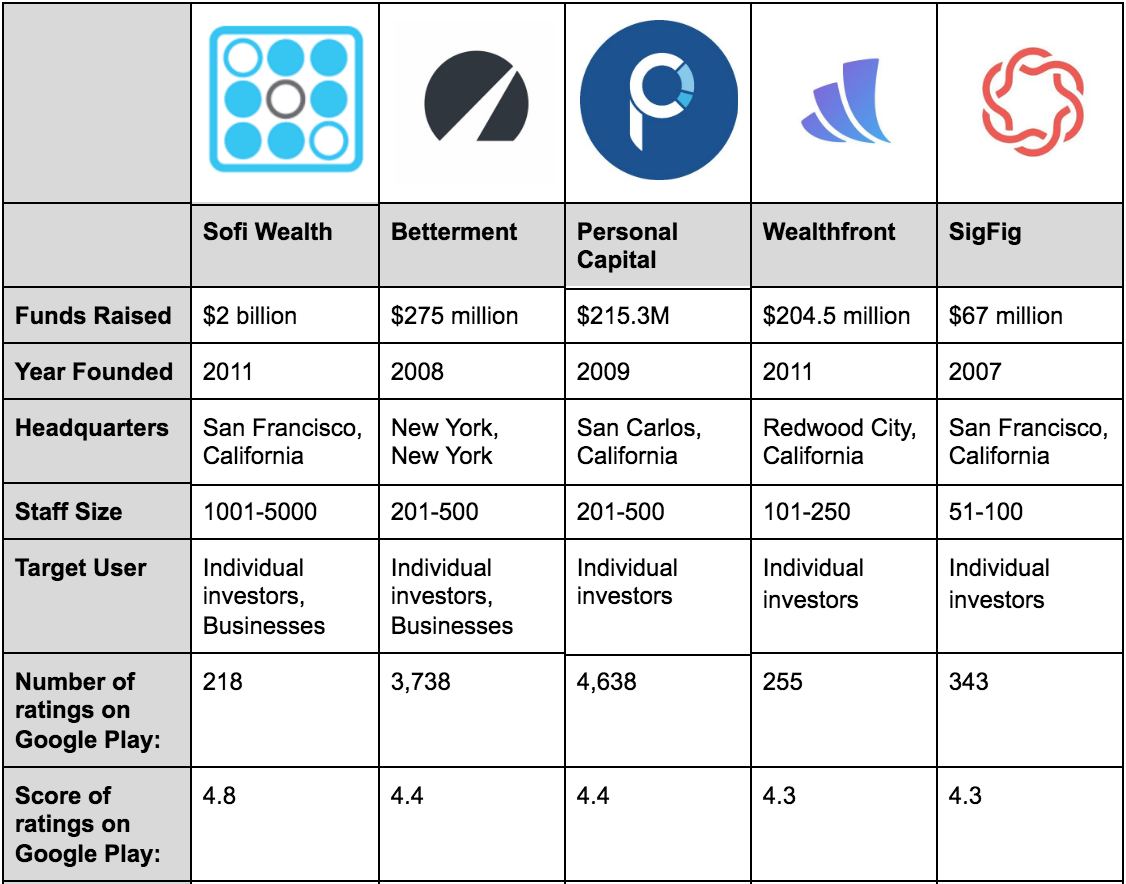

Robo-advisors and Artificial Intelligence – Comparing 5 Current Apps

Future of Robo-Advisors

Looking ahead, robo-advisors are expected to grow a lot. By 2025 and beyond, they might manage trillions of dollars. More will use advanced AI to give better advice and predict market changes.

Hybrid models, combining robots with human experts, will become common. This helps with complex advice while keeping costs low. There will be more focus on personalized features, like sustainable investing or crypto options.

Challenges include regulations and building trust, but the trend is toward making investing even easier for everyone.